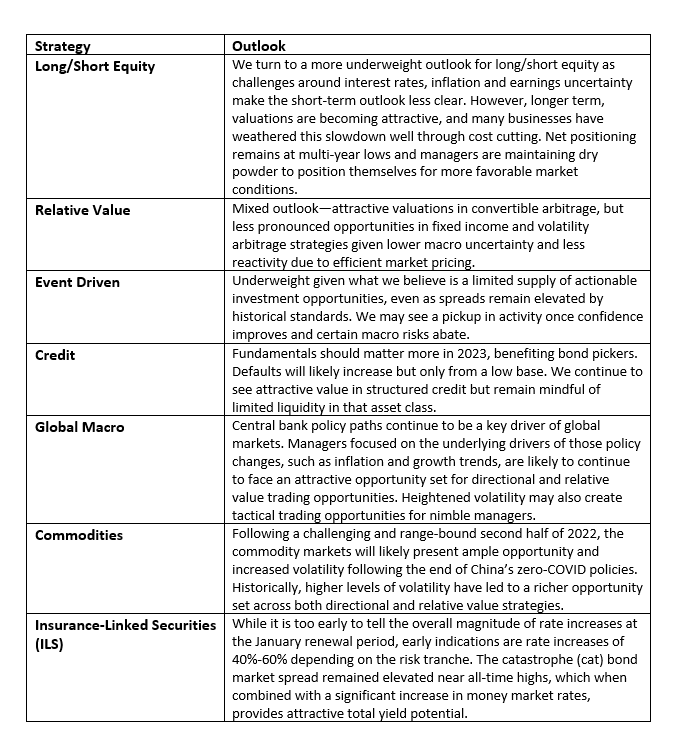

First quarter (Q1) 2023 outlook: Summary

We expect the first half of 2023 to be choppy as markets process inflation data. Later in the year, central banks should moderate interest-rate hikes, inducing a sustainable risk-asset rally. With the timing of these events being fluid, the volatility of volatility should be high, and market moves fleeting in duration early in the year. We believe such a market environment presents a rich opportunity set for tactical managers focused on security selection.

Strategy highlights

- Discretionary global macro: We expect macro factors to remain in focus, with investors closely watching inflation and growth data to set expectations for future policy shifts.

- Commodities: The shape of China’s reopening will likely have an outsized impact on global commodities with a potential increase in COVID cases pushing back the full recovery.

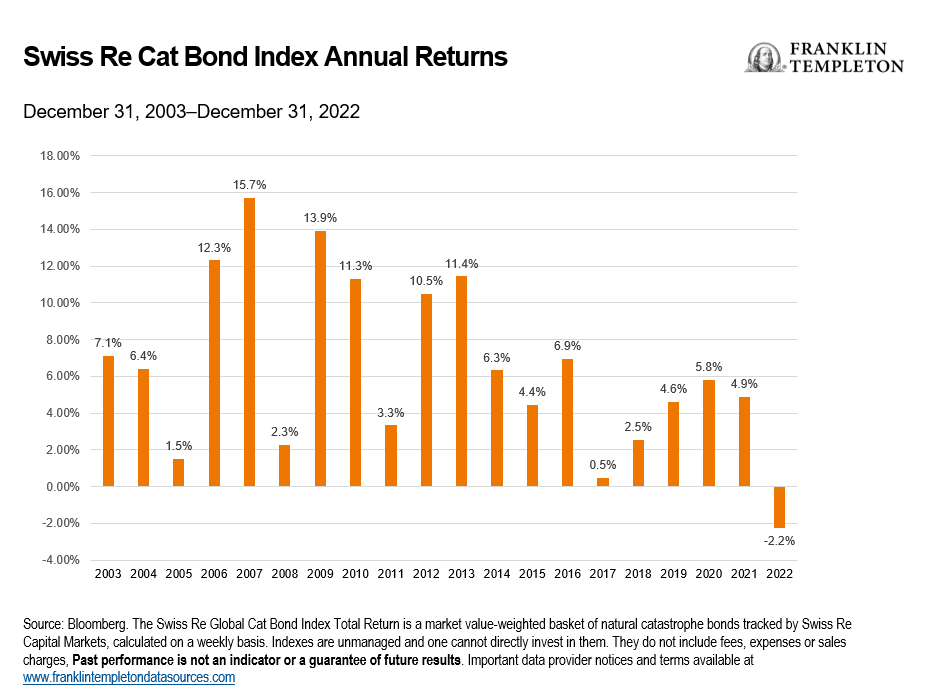

- Insurance-linked securities (ILS): The current market offers one of the most attractive entry points for ILS investors since asset class inception. Total yields are higher following Hurricane Ian, tighter reinsurance capital, and an increase in money market rates.

Macro themes we are discussing

The most important factor for the markets over the next 12 months will unequivocally be inflation and inflation expectations. The forward paths of both are highly uncertain being they are the aggregate result of many disparate inputs. Global central banks are attempting to quell price pressures with aggressive monetary policy and tightening financial conditions, while admitting that it is very difficult for them to manage inflation. The resulting market environment, which we believe will persist for the foreseeable future, is one of high uncertainty as the market prices forward expectations of when and how inflation will be tamed. Major price and liquidity dislocations typically accompany such regimes.

Given the complexities of the aggregate inputs to inflation, we find it highly unlikely that central banks will accomplish their goal. The most likely scenario is a policy error. Either they overstay on the tightening pedal too hard and too long causing major economic destruction. Or, they are too light on the pedal, causing inflation to run too hot for too long and eventually cause the markets to lose confidence in central banks.

Accordingly, we are prioritizing capital preservation with a strong preference toward managers that can capture long versus short alpha in shifting environments via nimble portfolios. Our high-conviction area in hedge funds is discretionary global macro managers, given the opportunity set for directional and relative value themes. We favor market neutral alpha-driven managers in equity long/short and fixed income. Rising cash rates in the fixed income markets could provide a ballast to strategies.

First quarter 2023 outlook: Strategy highlights

Discretionary global macro

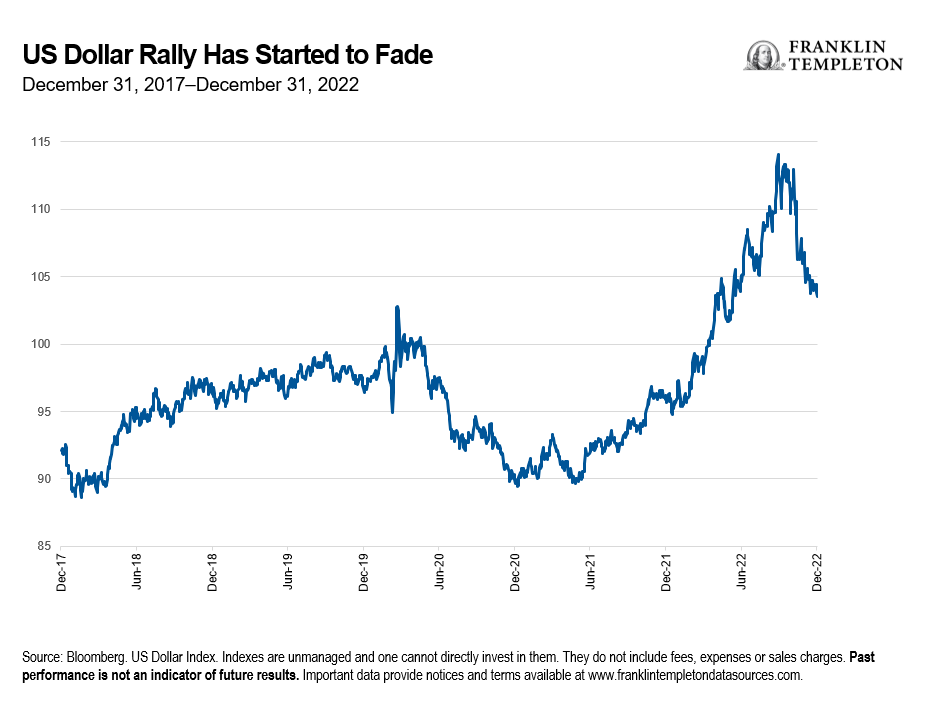

The US dollar staged a strong rally in 2022 until reversing itself in the fourth quarter. The re-emergence of large moves in currency markets is a reflection of heightened dispersion between regional fundamentals and policy paths. Discretionary macro managers, who often focus on such factors, may be well-placed to capture the opportunities these moves create. Significant momentum shifts in major markets like the US dollar can also have broad implications for other global markets, such as emerging markets and other asset classes. The persistence of these large, macro-driven moves can help create a robust opportunity set for macro managers.

Commodities

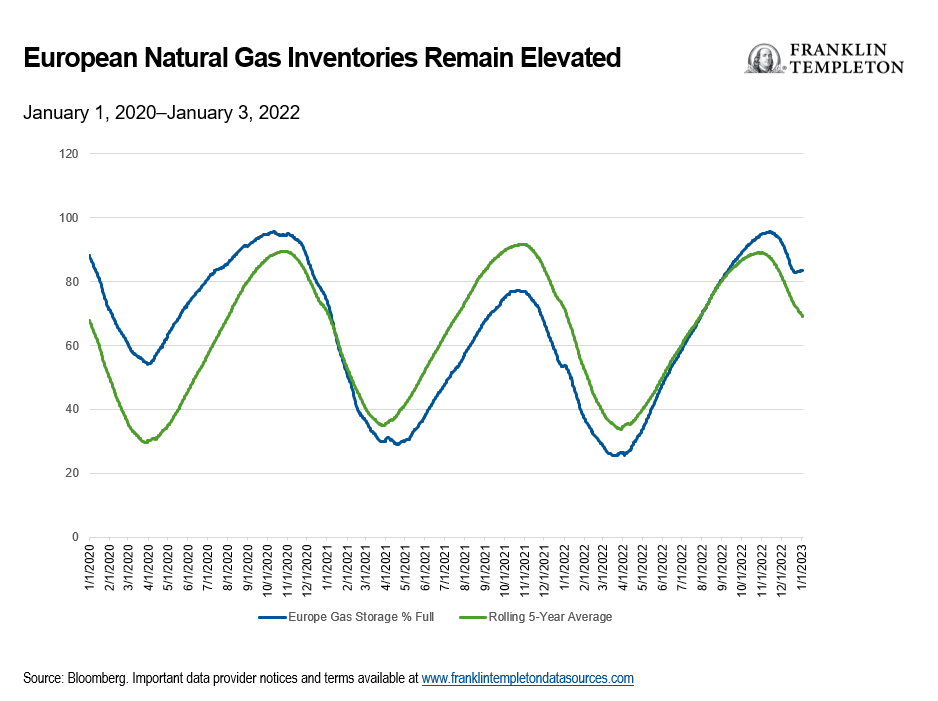

The beginning of 2023 picked up where 2022 left off as it relates to European energy, with a strong cushion of natural gas held in storage following a milder-than-normal start to the winter. A freezing start to December drained stockpiles of the fuel rapidly, wiping out about a third of capacity in the United Kingdom. But mild, wet and windy weather over the Christmas period curbed gas demand and actually allowed inventories to be refilled. At the beginning of 2023 Europe’s gas stocks were 14 percentage points above the five-year average. This is the largest gap since 2020, when most forms of energy were in major surplus due to the pandemic. More significantly, Germany was able to add about eight terawatt-hours, which is the equivalent to all the UK storage volumes, to its stockpiles in the last 10 days of December. Europe’s ample gas supplies, combined with forecasts for continued mild weather, have pushed the TTF natural gas contract to near the lowest level since before Russia’s invasion of Ukraine.

Insurance-linked securities (ILS)

Historically, following heavy years of event activity, the ILS market sees risk-adjusted rate increases as investors demand higher rates to assume the risk. The Swiss Re Cat Bond TR Index saw its first year of negative annual performance because of markdowns in the immediate aftermath of Hurricane Ian. Previously, after years of substantial loss impact, the cat bond market has posted strong returns in the following years. The initial loss reports from underlying sponsors and insurance companies have been lower than anticipated, leading to some price recovery through the fourth quarter. Further buoying our positive outlook toward the ILS asset class is its floating-rate structure. ILS instruments are priced as a spread above the risk-free rate. With a sizable increase in money market rates, the forward-looking total yield expectations are near the highest since the inception of the asset class.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

The post K2 Hedge Fund Strategy Outlook: First quarter 2023 appeared first on Beyond Bulls and Bears.